XCore

Industry’s Leading Trading & Aggregation Engine

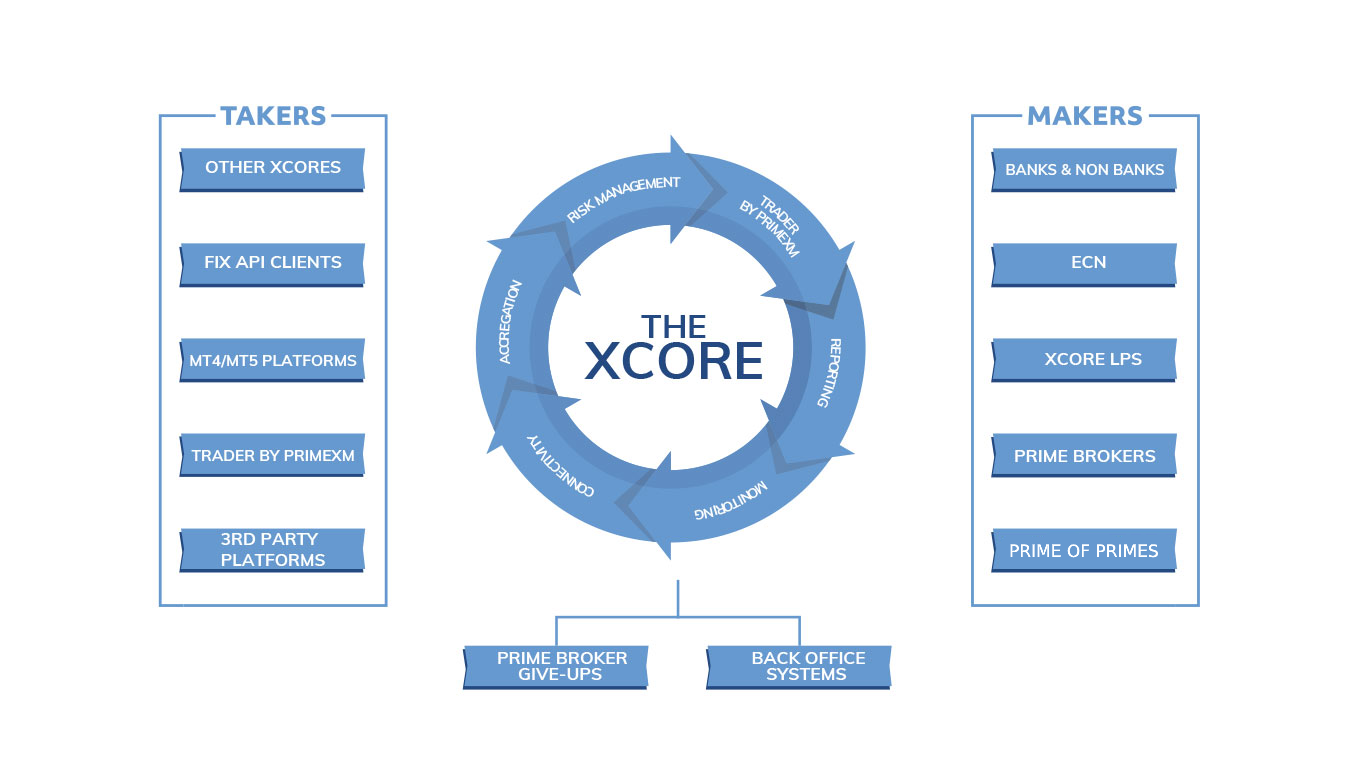

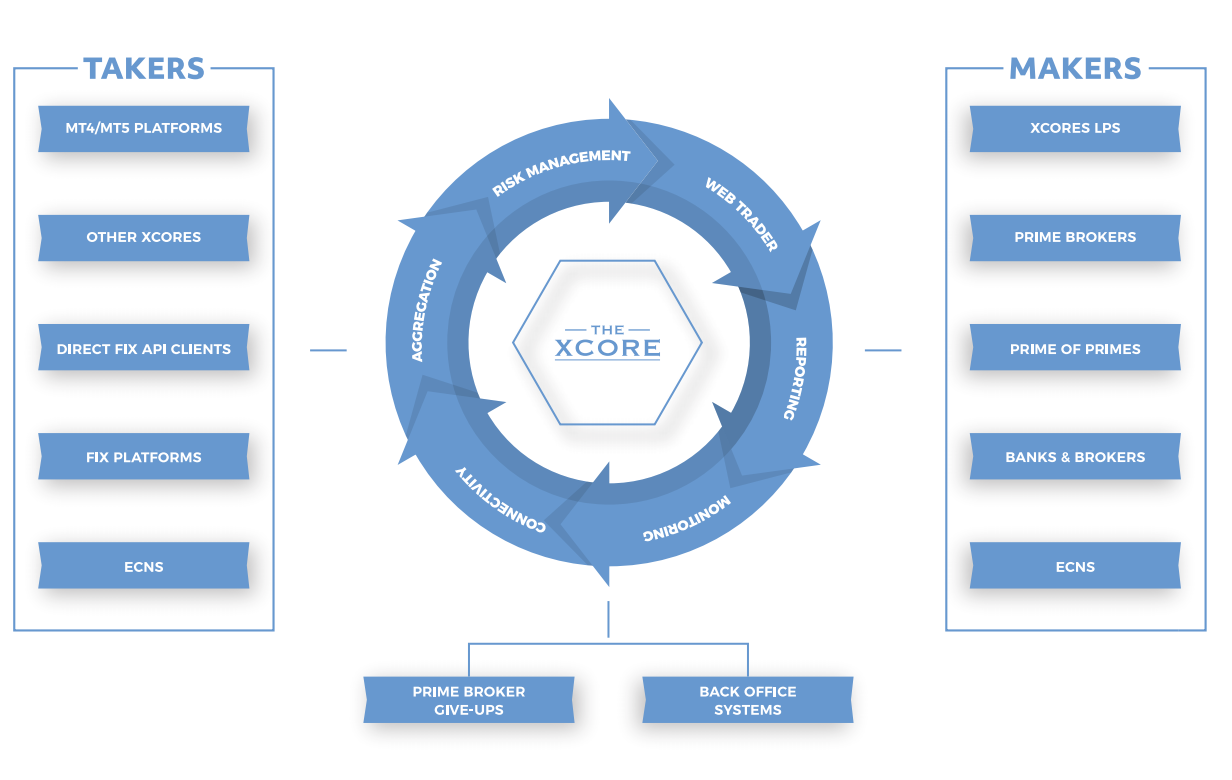

PrimeXM’s XCore is the industry leading solution for those seeking an ultra-low latency order management, risk and reporting solution.

XCore aggregates liquidity and supports multi asset classes, across an excess of 120 industry leading market makers, with support for multiple industry standard interfaces – such as MT4/MT5 and FIX API protocols – and PrimeXM’s proprietary Web Trading UI.

XCore allows to systematically manage your risk, internalising flow and managing exposure in real-time, and report both real-time and post trade to brokers, regulators and back-office systems.

PrimeXM’s XCore is the industry leading solution for those seeking an ultra-low latency order management, risk and reporting solution.

XCORE aggregates liquidity and supports multi asset classes, across an excess of 120 industry leading market makers, with support for multiple industry standard interfaces – such as MT4/MT5 and FIX API protocols – and PrimeXM’s proprietary Web Trading UI.

XCore allows you to systematically manage your risk, internalising flow and managing exposure in real-time, and report both real-time and post trade to brokers, regulators and back-office systems.

(Click image to enlarge)

Key Components

Integrations

PrimeXM’s XCore solution is integrated with over 120 industry leading liquidity sources, including tier-one banks, ECNs and Exchanges.

Aggregation

PrimeXM’s XCore's

solution supports multi-tiered best bid/offer aggregation, leading to better spreads and superior execution.

Risk Management

The XCore offers

great flexibility for a-book, b-book and custom execution models, allowing clients to fine-tune their settings.

Web Trader

PrimeXM has developed

a state of the art trading interface, enabling clients to offer more to both their professional traders and institutional clients alike.

Monitoring

PrimeXM’s monitoring components enable clients to track all actions and activity in real-time, through the many dashboards and log viewing tools included in the XCore interface.

Reporting

The reporting interface, a part of PrimeXM’s XCore high performance solution, provides clients with dedicated and customised reporting and analysis of their trading data.

Bridging

PrimeXM’s MT4 Bridge and MT5 Gateway is a powerful yet light-weight server side plugin which connects MT4 and MT5 platforms to the client’s XCore order management and reporting engine.

Analytics

PrimeXM MT Analytics is a powerful reporting and analytics tool, that allows users to run a variety of trade reports for a specified time interval.

More Information

Community

XCore’s growing community of 250+ partners facilitates the efficient and cost-effective exchange of liquidity.

Key Benefits

-

Crypto Assets Support

Trade Crypto currencies and make use up to 8 decimal digits trade execution capabilities.

-

Market Data Access

Diversify your product offering by leveraging the XCORE's native integration to market data vendors such as ICE,IB,CBOE.

-

Audit

The admin audit log shows a record of configuration actions performed in the XCore portal.

-

Portal Permisions

Ability to XCore owners to customize user access permissions and views.

-

Configuration API

Manage every aspect of the system in the most efficient waythrought the configuration API.

-

Report Manager

Generate Powerful post trade reports and insightful analytics, customized and filtered based on predefined templates and data profiles.

We are here to help you!

We can help you identify the most sophisticated solution for your business and answer any queries about our products and services. Request a call back and one of our advisers will be in touch.